MCStd Function Use Case 1: Standardized Regression Coefficients

Ivan Jacob Agaloos Pesigan

2025-10-19

Source:vignettes/mcstd-1-std-regression.Rmd

mcstd-1-std-regression.RmdThe MCStd() function is used to generate Monte Carlo

confidence intervals for standardized regression coefficients.

Data

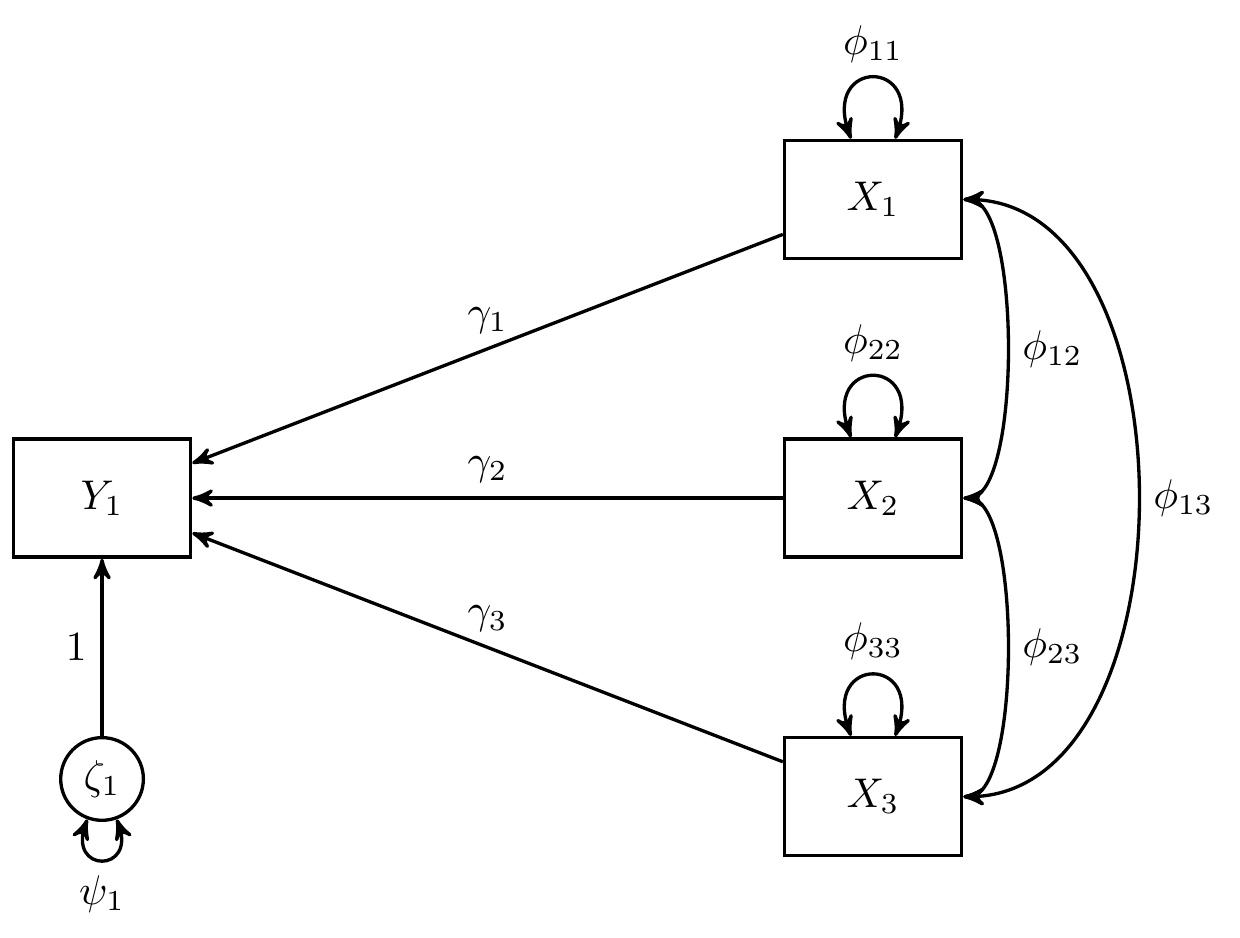

In this example, we use data from Kwan & Chan (2011) where child’s reading ability () is regressed on parental occupational status (), parental educational level (), and child’s home possession ()

Note that is the stochastic error term with expected value of zero and finite variance , is the intercept, and , , and are regression coefficients.

covs

#> Y1 X1 X2 X3

#> Y1 6088.8281 271.1429 49.5848 20.0337

#> X1 271.1429 226.2577 29.9232 4.8812

#> X2 49.5848 29.9232 9.0692 1.0312

#> X3 20.0337 4.8812 1.0312 0.8371

nobs

#> [1] 200Model Fitting

We can now fit the model using the sem() function from

lavaan with mimic = "eqs" to ensure

compatibility with results from Kwan & Chan

(2011).

Note: We recommend setting

fixed.x = FALSEwhen generating standardized estimates and confidence intervals to model the variances and covariances of the exogenous observed variables if they are assumed to be random. Iffixed.x = TRUE, which is the default setting inlavaan,MC()will fix the variances and the covariances of the exogenous observed variables to the sample values.

fit <- sem(

model = model, mimic = "eqs", fixed.x = FALSE,

sample.cov = covs, sample.nobs = nobs

)Standardized Monte Carlo Confidence Intervals

Standardized Monte Carlo Confidence intervals can be generated by

passing the result of the MC() function to the

MCStd() function.

unstd <- MC(fit, R = 20000L, alpha = 0.05)

MCStd(unstd, alpha = 0.05)

#> Standardized Monte Carlo Confidence Intervals

#> est se R 2.5% 97.5%

#> Y1~X1 0.1207 0.0900 20000 -0.0587 0.2950

#> Y1~X2 0.0491 0.0913 20000 -0.1297 0.2277

#> Y1~X3 0.2194 0.0709 20000 0.0781 0.3559

#> Y1~~Y1 0.9002 0.0404 20000 0.8003 0.9586

#> X1~~X1 1.0000 0.0000 20000 1.0000 1.0000

#> X1~~X2 0.6606 0.0406 20000 0.5743 0.7346

#> X1~~X3 0.3547 0.0627 20000 0.2256 0.4726

#> X2~~X2 1.0000 0.0000 20000 1.0000 1.0000

#> X2~~X3 0.3743 0.0619 20000 0.2455 0.4891

#> X3~~X3 1.0000 0.0000 20000 1.0000 1.0000